Store Catchments, Territory Boundaries and Market Holding Capacity - Setting Up for Success

As a location intelligence consultancy heavily involved in the Australian franchise sector, GapMaps’ is often asked about franchise territory design. Irrespective of the sector franchisors are working in or the service they’re providing, the questions we’re most frequently asked are ‘How many franchise territories can we create?’ and ‘How do we best define the territory boundaries?’

The answers and insights are equally relevant to the franchisor and the potential franchisees.

Primary Catchment Areas

Understanding and defining the primary catchment area the store (or mobile service) is covering is the starting point for franchise territory analysis. Primary catchment area here refers to the area within which the majority of customers will begin (or sometimes conclude) their purchase journey.

Franchisors are notoriously poor at estimating their primary catchment areas. When we ask franchisors about the catchment area their business serves, they’ll routinely talk about the customer who travels at least 10km, or 15 minutes, to visit them. But when determining catchment areas, we’re solely interested in what the majority of customers do and not what ‘outliers’ do.

Because franchisors are poor at estimating catchment areas, and because it’s fundamentally important for assessing franchise territory potential, we’re strong advocates for the collection of customer address data. It doesn’t need to be personalised and in most cases, it doesn’t require street number or name, but collecting suburb data and attaching that to a customer name or customer ID is enormously valuable.

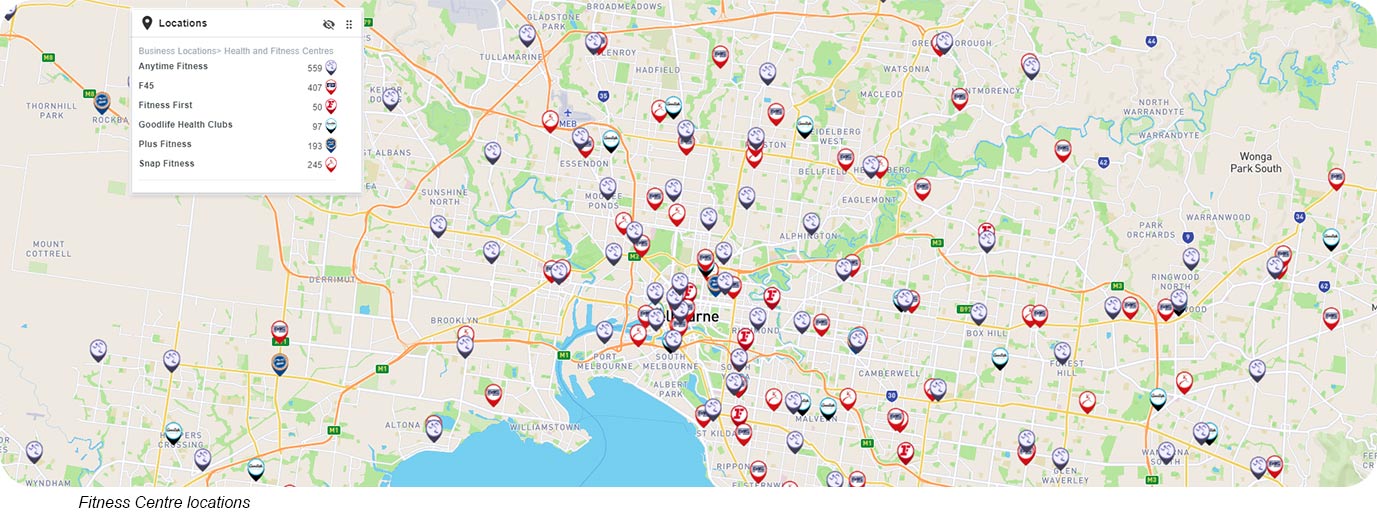

So how large are the primary catchments? The answer is usually about half as large as the franchisor initially thinks. A childcare centre primary catchment will typically be around 2km or less than five minutes, a pharmacy is similar and a café in a commercial area might have a primary catchment as small as 100 metres. We work with many fitness and wellness franchise systems and their primary catchments rarely extend beyond 5 minutes.

Franchise territory sizes should largely align with the primary catchment area. If the territories are too large there will be customers who find the franchise location inconvenient to visit, or, in the case of a mobile franchise system, the customers will be too far away for the franchisee to conveniently and efficiently serve. And if the franchise territories are too small there will be insufficient customers within each territory and inevitably there will be cannibalisation, with franchisees competing for the same customer.

Specifically for franchisees, the territories provide protection from unwanted competition from other outlets sharing the same brand. We’ve all seen examples of franchisors seeking to maximise their revenues by squeezing to many territories in a market, to the detriment of the incumbent franchisees. As a franchisee, you should be seeking information from the franchisor about existing customers and the distance they’re travelling from home (or work) to visit existing outlets in the network. There’s a lot to be learned from analysing and understanding existing customer behaviours.

How big should we allow those territories to grow? Only as large as we can see evidence of customers being willing to travel to the existing locations.

Target Customers and Penetration Rates

When establishing the catchment size, we’re interested in defining the target customer within the catchment. All people within a catchment do not have equal value for the franchisee – some will be likely to visit regularly, some might sometimes visit, and many others will not transact with the business at all. There are many ways to define a core customer and demographic criteria are often very useful – what gender, age, income, family grouping, profession etc. best describes the core customer?

Once the core customer profile is defined, we can calculate the customer penetration rate. At this point a case study may be useful. Suppose a fitness club has 1,000 members and their target customer is aged 20-35 with a personal income above $85,000 or household income above $110,000. If there are 10,000 of those people (target customers) within the primary catchment area, and 1,000 of them are club members, we have a penetration rate of 10 percent.

Continuing with the fitness club example, if we know that a successful club requires 1,000 members and we know that existing clubs have a penetration rate of 10 percent, then we also know that each new territory needs to provide at least 10,000 target customers within an area that’s not so large as to extend beyond the travel times that customers are prepared to travel.

Franchisees should be seeking a clear definition of the target customer from the franchisor. That should include the basic demographics factors – age, gender, income etc. but also life stage and life style factors. Once you’re clear about whom to target as a potential customer, you then need to know how many of that type of person exists within the proposed territory and how that compares with other successful territories within the franchised network.

De-risk growth by replicating what already works

Using this methodology, you can see that we’re forecasting business performance across new geographic areas based on what has already been evidenced to work. Growing a franchise system is both complex and challenging, and we can de-risk growth by replicating what has been proven to work.

And how big to we allow those territories to grow? Only as large as we can see evidence of customers being willing to travel at the existing locations. So, if the primary catchment area in the existing locations reflects a travel time of, say, five minutes, we don’t want to design new territories that need to be ten minutes in size to amass the required 10,000 target customers. That’s not to say these larger territories can’t work, but it is to say that there’s no evidence based on current customer behaviour, to support creating such large territories. In this example, if a new franchisee with the new larger 10-minute territory captures 10 percent of the target customers within a five-minute travel time (in line with the existing clubs) they’ll fall well short of attracting the target 1,000 club members.

We also need to reflect on the fact that outlet performance is a function of not just the catchment but also the micro location attributes. For example, a café requires a retail strip or shopping centre which it can anchor to, and our analysis consistently shows that better performing fitness clubs and wellness centres are attached to retail strips or neighbourhood precincts with a major supermarket. When designing or building territories we’ll set minimum criteria relating to the presence of other retail activity in the territory, and we’ll often ensure there is a hub of the desired retail activity in the centre of each territory that we design.

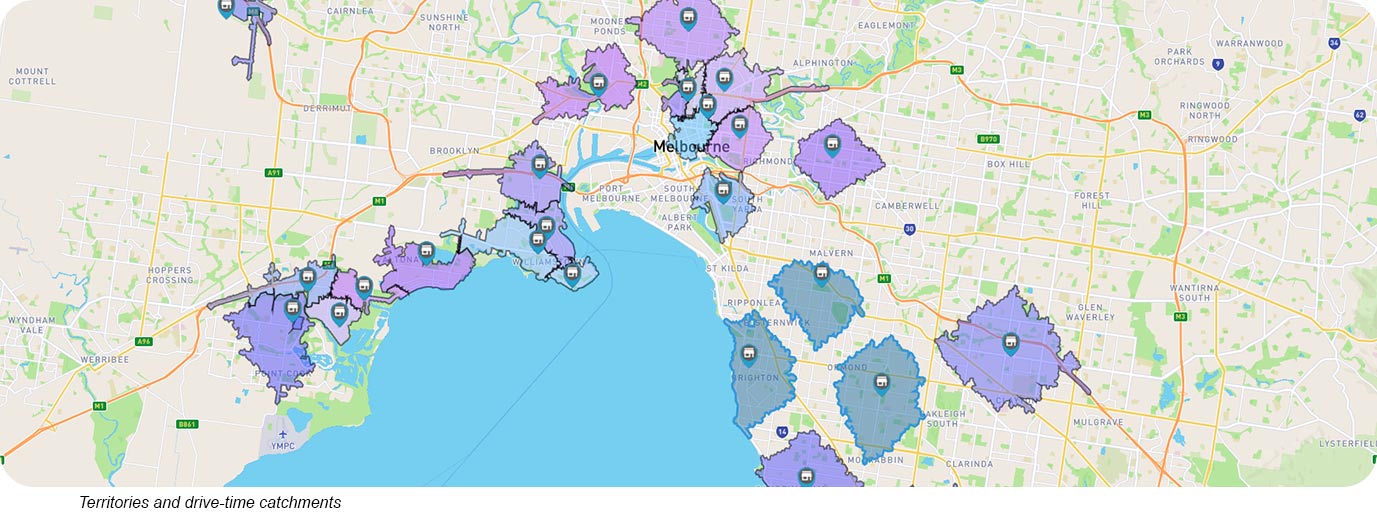

The final territory design question relates to the territory boundaries. In this example we’ve discussed a five-minute travel time but that provides a boundary line that can only be viewed on a map and it’s very difficult to describe the territory area to a potential franchisee. Our approach is usually to grow the territory size using suburb boundaries until the desired count of target customers is reached. And we don’t allow the territories to grow beyond the known travel times of existing customers. Suburb boundaries are better than postcode boundaries as postcodes are often too large and there are also instances where they have very unusual shapes. In some instances, we can use smaller geographic boundaries like Statistical Area Level 1, but they’re also difficult to describe to an incoming franchisee.

How Many Territories?

With the territory criteria being defined, we’re able to answer questions relating to the theoretical maximum number of territories that can be established, or what we call the market holding capacity. This requires some spatial mapping software and calculates the total number of territories that satisfy the design requirements (target customer count plus micro location attributes) within an area that doesn’t exceed the established maximum geographic size.

It’s often the case in regional markets that customers are prepared to travel a little further to visit a retailer. When designing franchise territories this will often mean the imposed maximum territory size will be expanded – so the five-minute maximum travel time in metro might become seven minutes in regional markets.

Once all territories are designed (and counted), the franchisor should consider how best to progressively sell the territories. Consideration needs to be given to both timelines and geographic areas.

As a franchisee, you may seek reassurance that adjacent franchise territories may not be released within defined time periods. This may be particularly important for new franchise systems which do tend to commence trade with catchment sizes that are larger than ‘normal’. The concept may be fresh and unique but over time becomes more convenience based.

Make use of what we have and collecting customer data

We’re fortunate in Australia to have access to some of the most granular and informative demographic and retail data in the world. Our clients in Southeast Asia would love to have data even half as good as we have here in Australia. But for all that is available to us, it’s not particularly helpful if the franchisees in the system aren’t collecting their own customer data. The starting point for franchise territory analysis and building boundaries will always be understanding and leveraging what we know about existing customer behaviours.

As a franchisee you should be asking questions about the territories that are being offered. You should expect the franchisor to be able to explain how the territories have been designed and why they’re the right size and composition for you. Ask to see customer data evidencing the length of the trip customers are making to visit existing outlets in the network. Even the best operators in the country can’t be successful if there’s an insufficient number of target customers within the catchment.