How to Optimise Retail Site Selection

Why retail site selection is so important?

There are few business decisions that can impact a company’s bottom line more than the decision to invest in a new store location. Make a poor decision and the costs implications are huge.

Consider all these expenses you could face:

• rent

• fit-out

• operating losses

• lease termination payments

• asset write-off

• legal fees & etc.

Add to that the executive management time spent on trying to fix a low performing store and the total cost could very quickly be measured in the hundreds of thousands, if not millions, of dollars.

On the other hand, get this decision right and the new location can be among the most profitable in your network.

Know your customer

Many business owners have thought carefully about their core customer profile – age, income, sex, family structure, life stage, life-event, psychographics — and that’s a good start.

It’s also important to consider the customer’s travel path (see our article on Understanding Store Catchments) associated with their purchasing behaviour and ask:

• Is the customer purchasing close to home or close to work?

• How far are they travelling from home or work?

• Is the customer bundling the purchase with another activity or is it a destination in itself?

Capture customer data

Capturing customer location data is key – and for most businesses that’s about where the customer lives and which store they’re shopping at. Unless you’re mailing them, you don’t need to know a customer’s precise street address and few will object to providing their suburb or postcode as part of a registration process or at the point of sale. If deliveries are made to the customer, then you already have their address.

With GapMaps Live, you can use Visitation Data to help identify the areas where your customers live and work. This can help you make superior site selection decisions.

Factor in distance decay

What you’re trying to understand is what we call ‘distance decay’ — the distance beyond which most customers stop visiting a particular shop because it’s too inconvenient to visit regularly.

For many ‘local’ businesses like cafes, childcare centres and convenience retail outlets their distance decay looks like this:

• 50% of customers will live within 5 minutes or 2km

• 75% of customers will live within 7 minutes or 3km

• 25% of customers are outliers who live further away

The distance decay is a critical insight for site selection because it informs decisions about how close the new stores can be to existing stores without creating excessive cannibalisation or leaving gaps between stores in high trade potential areas.

Exceptions don’t prove the rule

When we talk to business owners about their customers and travel distances, they often tell us about the customer who drives 30 minutes or more to visit them every week.

It’s an interesting exception but irrelevant to your network growth strategy. We’re only interested in how the majority of customers behave when deciding to visit your store.

Analyse your store catchment

If you have one or more successful stores and you’ve been through the Know Your Customer process, then it makes sense to understand where those customer’s live and nearby competitors relative to the store’s location.

An analysis of your existing store location can provide a precise summation of the catchment characteristics. The summary should include the count of target customers by factors like these:

• age

• income

• ethnicity

• family structure

• dwelling type

• or any of the multitude of variables collected through the census process.

With GapMaps Live you can run a catchment report to get the most up-to-date view of demographic characteristics, population changes, socioeconomics and much more across any location.

For B2B businesses, an extract from the Australian Business Register might provide better catchment insight. Other insights, like household expenditures on specific retail categories, can also be obtained.

For retail and B2B businesses, consider the importance of competing brands and whether your existing high performing store is located near your competitors. If you’re selling cars, how many other showrooms are nearby? If your store is a restaurant, are there others near you?

Or perhaps your better performing locations have little in the way of direct competition.

Ask yourself:

• How many competitors are located within 200m of the store, within 500m, within 1km, 5km?

• Are there reference or anchor brands that are positively influencing sales?

• Who are they and how close are they to your store?

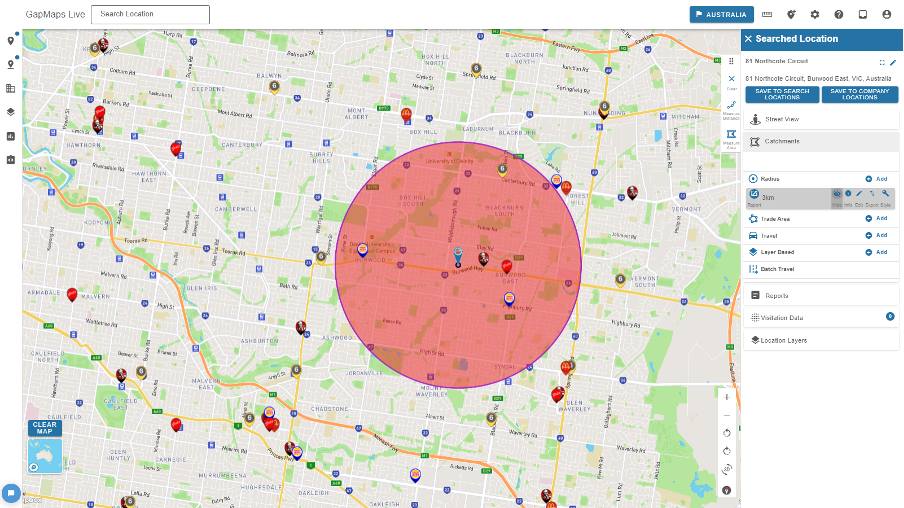

Below is a graphical representation from GapMaps Live of some popular fast food brands located within 3km of a proposed location.

Identify business generators & location types

One of top considerations for some businesses is to locate near a ‘business generator’. That’s any large location with a high density of people like schools, universities and shopping centres.

Consider also the location type of your existing high performing store. Is it in a neighbourhood shopping centre, or a large format retail centre or is it located on a retail high street?

GapMaps Live gives you the most up-to-date view of competitor and reference brand locations and business generators like shopping centres, schools and universities which takes the guesswork out of site selection decisions.

Replicate what you know works

The lowest risk and high performing potential locations will be those that replicate what you’ve already proven works for your business.

By defining what characterises your existing location, it becomes possible to search a market area for new catchments that replicate those same characteristics.

There are very few locations in Australia that are genuinely unique. In almost all cases there are relatively large numbers of locations that are very similar to existing successful locations.

Score and rank sites

Those location opportunities might then be scored and ranked according to how closely they match your existing high performing locations. The site selection strategy should start with locations at the top of the list because they most closely match what you know works.

Use the latest data to inform site selection decisions data

We’re fortunate in Australia to have some of the best census, household spending and customer profile data in the world. GapMaps only uses the very best, validated and current data sets.

Today, making use of location intelligence is no longer an expensive luxury afforded only by the global corporates and the largest of Australia’s retailers.

Making fact-based, low risk site selection decisions is not a secret – it’s just about collecting and analysing high quality data to create insights and make informed decisions.

Of course, it helps when you’re dealing with experts with a long and successful history of helping hundreds of clients optimise their retail site selection.

Retail site selection has never been easier. GapMaps Live is the only tool you need to make better location decisions, faster.

Connect with GapMaps

If you’d like to chat about how we can help you optimise site selection to successfully grow your business, please get in touch.