Shopping Malls in India – the long haul back

This post was originally published on ET Retail.com.

After a very difficult 2020 and with the development of a successful vaccine to combat COVID-19 now seemingly assured, we can begin to take stock of the damage that COVID-19 has inflicted on the country’s shopping malls, with the hope to steadily improve the circumstances.

It is still early to definitively pronounce the likely date of return to “normalcy” for shopping malls or what the new normal will look like. There is, however, an increasingly wide array of information available to help us understand where we are on the path to recovery. One conclusion which can be drawn such information sources with some confidence, we believe, is that a significant amount of the ground lost by shopping malls in India during the lockdown has already been recovered.

GapMaps device data provides a clear understanding of the impact on footfalls – both before the lockdown and in the various phases of unlock.

Personal mobility data collected via smartphone usage, often referred to as device data or mobile device data, is one such source of information. It provides a powerful and insightful tool to measure the changes in visitation patterns, both negative and positive, in near real-time. GapMaps device data provides a clear understanding of the impact on footfalls – both before the lockdown and in the various phases of unlock.

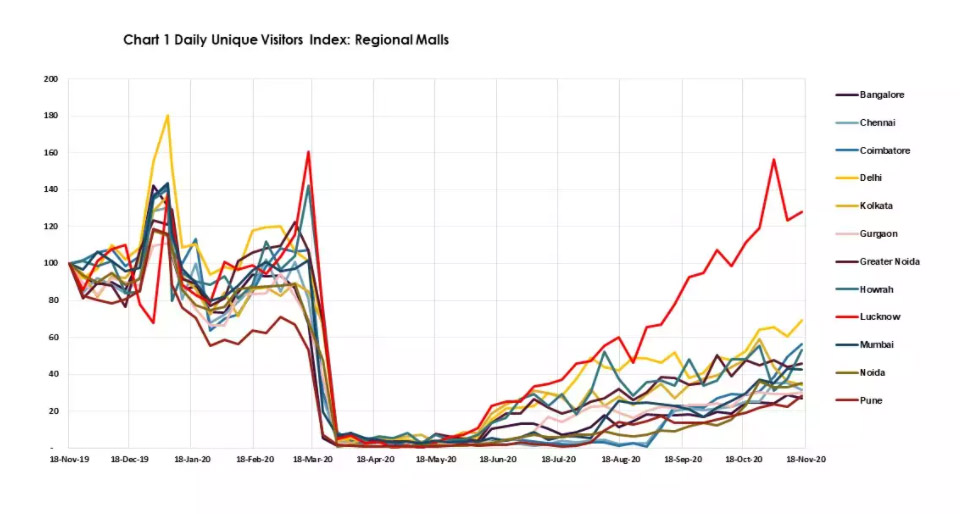

The benchmark data presented below reflects the aggregated findings across 24 leading malls in India, the vast majority of which are located in India’s Tier-1 cities. Chart 1 shows the 12-month mall traffic trends in each city, commenced in mid-November 2019.

The drop in mall traffic was quick and dramatic, with malls in all cities seeing their visitation levels drop to zero or close to zero in the week commencing March 23, as a result of the lockdown across the country. This was until mid-June when a slow climb back began. With the onset of the festive season, levels had climbed back to 60%-70% of pre-COVID levels in some cases, and in Lucknow it was even higher. Across most cities, however, in mid-November, levels were trending at 30%-60% of pre-COVID levels.

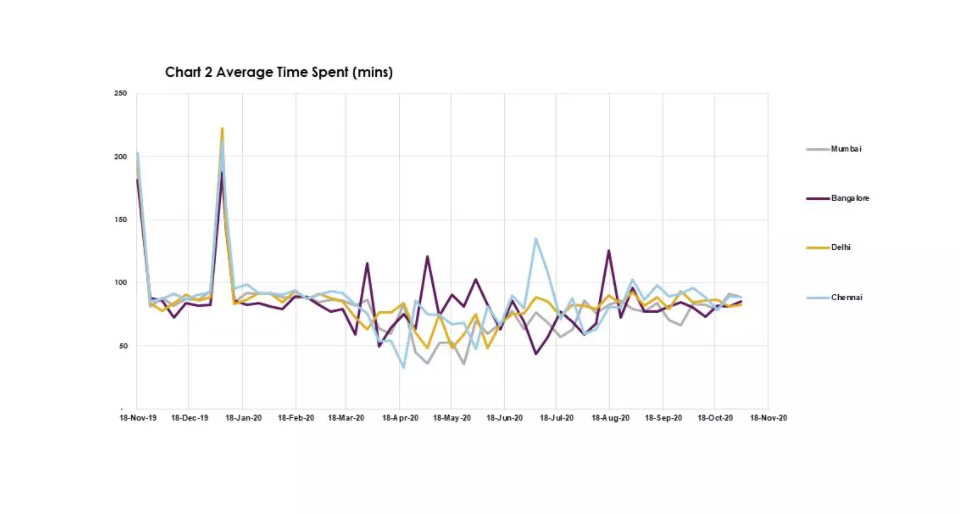

Chart 2 below shows that as customers have slowly returned, their visitation habits, at the duration of the visit, are also trending back to pre-COVID levels – now averaging 80-90 minutes in most cases, compared to 50-60 minutes during the period between March and June.

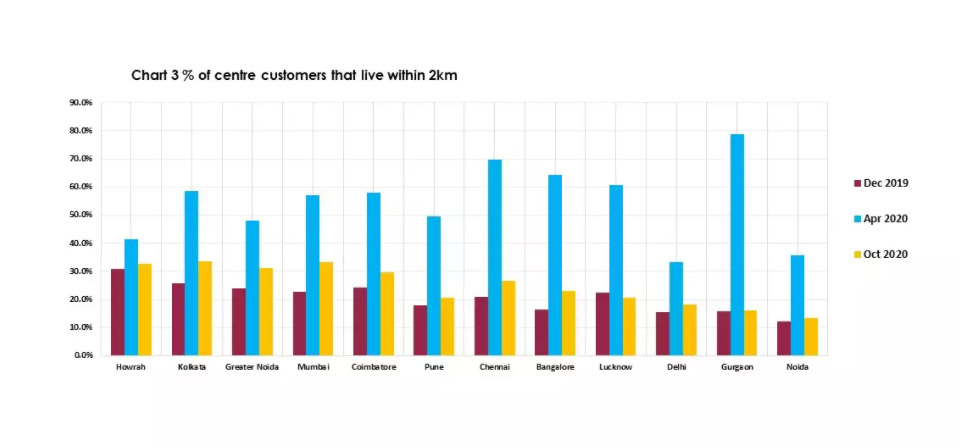

One of the global trends reported during the COVID-19 lockdown periods has been the so-called “return to local”, with most shoppers tending to focus their shopping on centres located closer to their homes. For regional malls, which typically thrive when able to attract customers from a broad region, this change in behaviour, if permanent, spells potential problems.

Chart 3 below shows that the pandemic has altered the distances that shoppers are prepared to travel. When in most cases only 15%-30% of regional mall customers travelled two kilometres or less to visit, during April, that proportion increased to 50%-60 %. However, by October, the proportion had fallen back close to pre-COVID levels, i.e., shoppers were gaining confidence to again travel greater distances to visit their favourite malls.

GapMap’s mobile device data is a cutting-edge offering in the region that provides a never before available opportunity to track the recovery period and to understand the nature of the changes. This helps the industry to analyse at a granular level and also to monitor whether visitation patterns are transitioning back to the old normal or will settle with some form of new normal.

Importantly, mobile device data can also be utilised for any specific mall to measure any or all of the above, and then to compare or contrast that mall’s performance with the relevant benchmarks for its peer centres.